Navigating crypto space through science

Founded in 2020, Warp Capital is one of the pioneering institutional crypto funds for qualified investors in Eastern Europe. Our journey began with Decentralized Finance (DeFi), where we became market leaders in developing delta-neutral strategies, including farming, staking, and advanced covered liquidity provision techniques. In mid-2022, we expanded into directional strategies to capitalize on key entry points in the crypto market. By 2024, our portfolio further evolved to include participation in private funding rounds.

Our investment approach is grounded in rigorous scientific and fundamental research of major crypto assets, with a focus on holder structure, demand and supply dynamics. We employ advanced statistical methods to determine optimal portfolio weights at each stage of the market cycle.

Warp Capital collaborates with U/HNWIs, asset managers, and financial institutions, providing tailored strategies and insights.

Directional long-term strategies with flexible risk management.

Market-neutral strategies, including basis trading, farming and staking.

Participation in private funding rounds.

Investors hold the keys to a multi-signature smart contract or wallet, ensuring no changes can be made without their approval. Additionally, there is an option for investors to independently recover funds in case of an emergency.

Warp Capital uses its own capital to test and develop new investment strategies and structured products. Client funds are never used for testing.

We implement industry-leading solutions to provide secure and distributed access control over invested funds.

Over 15 years of experience in traditional financial markets and over 8 years in cryptocurrency markets, delivering the highest possible returns within predefined risk parameters.

A flexible approach tailored to the needs of family offices and U/HNWIs, with a deep understanding of their processes, concerns, and objectives. Our team has managed portfolios exceeding $300M across venture capital, liquid crypto, and equities.

In-depth expert analysis of global trends in digital assets and blockchain technology.

Access to leading crypto projects and their key founders worldwide.

Direct partnerships with blockchain development firms, representing a combined 200+ full-time software engineers.

Co-investments with top-tier venture capital firms, unlocking unique opportunities in the crypto space.

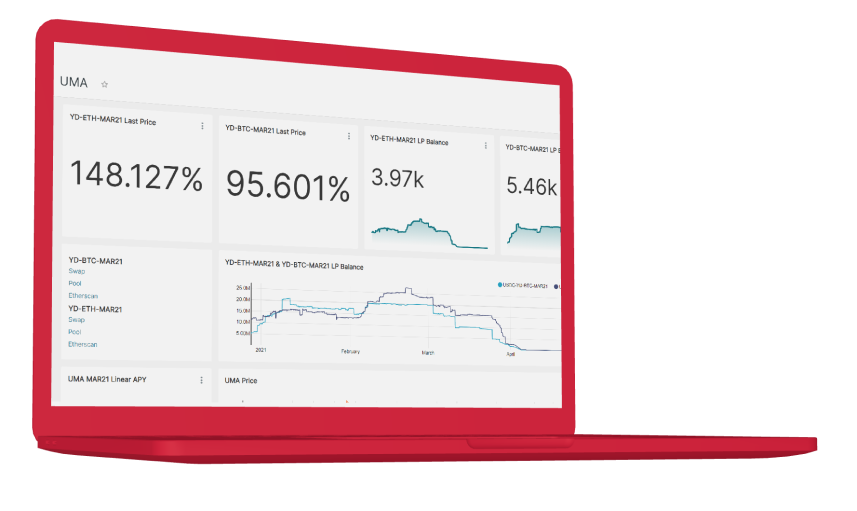

Cutting-edge proprietary tools for statistical analysis and market simulation.

Automated monitoring of capital flows, holder composition, and segregated asset pools.

Continuous security audits of program code and infrastructure.

Our directional strategy for Bitcoin is driven by a fundamental analysis of the supply structure and future demand forecasts, enabling us to identify profitable entry and exit points throughout the market cycle.

By applying a fundamental, statistics-based approach that leverages advanced simulation techniques, we determine the optimal asset weights for each stage of the market cycle.

Proprietary set of fundamental demand and supply indicators allowed us to detect market top and rebalance our benchmark portfolio at average $102k per Bitcoin.

Ability to maintain full control of funds within the investor's family office. The entire infrastructure is designed to avoid reliance on a single custodian.

Strategies are customized for each Investor based on risk appetite and specific risks of to particular crypto sectors, allowing maximization of future profits.

Our secured physical infrastructure is adaptable to meet specific client requirements, with comprehensive training provided for family office or asset management staff.

We are open to work with qualified investors only. Investors can participate through lean and flexible legal structures, designed to mitigate the impact of geopolitical changes on crypto adoption and other relevant legal risks.

Qualified retail clients (with a net liquid worth exceeding $100k and targeting investments starting from $50k) can also participate through a set of funds across various jurisdictions, utilizing Warp’s strategies.

Minimum investment

$100K

$1M

for treasury control

Withdrawals

Monthly

with 30 days’ notice

Lockup

No lockups for direct participation

As per fund's terms for retail clients

Reporting period

Monthly